10 Things to know about Currency Trading in India

Contents:

As you can see, utilizing standard lots allows gaining a large profit from a single deal and actually making a living from Forex trading solely, but you must bear in mind that the risks are increased as well. Let us explain this system to you by giving a precise example. So, if you plan to speculate on the USD/CAD pair, the standard lot will equal $100,000 as the US dollar will be the base currency.

You can use a https://1investing.in/ card and cash for transactions while you travel. In case you run out of cash, you can always reload your forex card from anywhere. However, post your trip there are chances that you may still have a foreign currency that you wouldn’t really be required anymore. Thomas Cook Forex Services can help you buy and sell forex at the best possible rates.

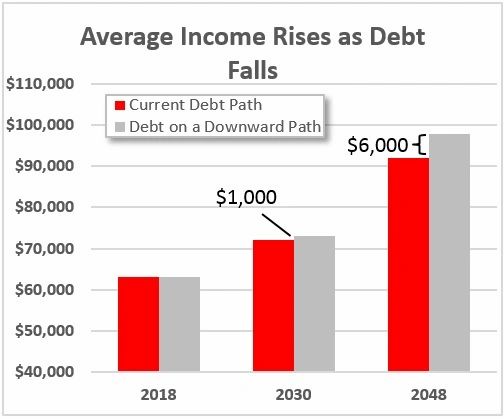

US Debt Ceiling: Lessons from the 2011 Budget Debate – Forex Factory

US Debt Ceiling: Lessons from the 2011 Budget Debate.

Posted: Mon, 24 Apr 2023 16:05:00 GMT [source]

Currency trading in India is only allowed in 7 pairs- USD/INR, EUR/INR, JPY/INR, GBP/INR, EUR/USD, GBP/USD, and USD/JPY. Three stock exchanges facilitate forex trading in India- NSE, BSE and Metropolitan Stock Exchange of India- jointly regulated by SEBI and RBI. USD/INR, EUR/INR, and GBP/INR lot sizes are 100 units, and JPY/INR lot size is 1,00,000 units. If you have an online trading account, you don’t need any additional permission to do currency trading. You can buy and sell currency pairs on the NSE or the BSE currency segment. Commercial and Investment banks are one of the major players in the currency markets and the greatest volume of currency is traded in the interbank market.

Trade Stock CFDs and discover the benefits of CFD trading with IFC Markets

It is an extremely important and critical for businesses, imports and exports, travellers, tourists, immigrants, investors and banks both domestic and international. I developed an interest in forex way back in 2018, I started learning the basics and soon became a professional on the subject. I started teaching a lot of people physically at their homes how to trade forex.

What is forex trading? – USA TODAY Blueprint – USA TODAY

What is forex trading? – USA TODAY Blueprint.

Posted: Thu, 23 Mar 2023 07:00:00 GMT [source]

As the official language puts it, expiry happens two working days before the final working day of the month. The settlement of forex derivatives happens on the final working day of the expiry month. We interact with our loyal customers to co-create unique experiences that will take your holiday to the next level. Update your mobile number & email Id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020. I say this because most people I tutor are beginners completely new to forex, so they make a lot of mistakes in identifying patterns in the market.

XAU/USD – Gold Spot US Dollar News & Analysis

It’s not the bragging game but we truly are the all-rounders of holidays and we can vouch for that. Travel anywhere in the world, your flight, hotel booking, sightseeing and most importantly your comfort is our responsibility. Our tour packages in India will acquaint you with serene backwaters of Kerala, mystic hills of Ladakh, the grandeur of Udaipur, untouched beauty of North East and carefree vibes of Goa.

A currency futures is a forward agreement that allows exchanging one currency for another at a future date at a specified purchase price. Spot FX contracts deliver the underlying currency immediately from the settlement date. The main difference between contracts is when the transaction price is determined and when the physical exchange of currency pairs takes place. Like the stock markets, the capital market regulator SEBI regulates Forex trading in India. They ensure that the companies comply with the Foreign Exchange Control Act of 1999.

The only thing one can do is study the historical data, the above conditions and then make an educated, calculated guess in order to buy and sell foreign exchange. The value of every currency is different and this is determined by the economic status of the country. Does it make you wonder as to why foreign currency matters to us? Forex is extremely important for import and export without which we would have limited access to goods and services.

The global forex market in 2022 will be worth $2.409 billion ($2.409 trillion). The average daily volume of the forex market is around $6.6 trillion. A cross-currency refers to a currency pair or transaction that does not involve the U.S. And RBI does allow cross currency pairs to be traded in the derivatives market in India.

There are a lot of features and benefits on carrying foreign cash; chief among them is the buy-back policy by which we can ensure any unused foreign currency cash can be encashed. Other features and benefits of Foreign Currency Cash include being able to choose the currency you want. Since more than 14 currencies are available in various denominations. If you have further queries regarding this, please feel free to get in touch with us.

Top rated products

Our vision to give you a seamless holiday experience makes us one of the leading tour operators in the ever-expanding travel industry. Since holidays are more about personal choices and interests, we bring to you customizable tour packages as well. We give you the prerogative to pick and choose anything that matches your interest.

In our example, the US dollar would be the base currency and the Indian Rupee would be the quote currency. In a currency pair, the value of the base currency is always 1, so a USD/INR currency pair signifies that one can buy 1 US dollar against 78.75 Indian Rupees, if the exchange rate is 78.75. Last week, the central bank removed a cap on exchange rates and the government raised fuel prices by 16 per cent. The second one is the futures market where currency futures are traded. In the Indian currency market, futures is the preferred way of doing trades.

The colors, the pictures, the name and sign of the currency – it would transport me to a different world – a place where I saw myself traveling to different countries around the world. As I grew, I did travel to many different countries and my collection of coins and bank notes of different currencies kept growing. This interest in collecting different currencies soon developed into studying the connection between one currency with another and very soon into the world of trading foreign currency or FOREX as it is called. My interest led me to ; a website, where I learned everything about Forex trading and started my trading activities from and have continued since. No need to issue cheques by investors while subscribing to IPO.

Share

Having adequate margins will preclude sudden need for additional margin in case the market turns unfavourably volatile with respect to your position. Upon execution of the deal on the exchange, the lien amount is reduced and debited to the client’s account at the End of the day. A) If there is any credit available in client’s deactivated margin account with the Bank, it would be refunded at the client’s request. The presentation about using the platform to place trades would be sent to the client via email after the opening of the SBI FX Trade account. Similar, long or short positions can be taken in EUR/INR, GBP/INR and JPY/INR if customers see any chances of fluctuation in the Indian currency against other currencies like Euro, Sterling Pound and Japanese Yen. Settlement for the customer is, however, done in Rupee terms and not in the foreign currency.

Will Australia CPI Let The RBA Keep The Pause? – Forex Factory

Will Australia CPI Let The RBA Keep The Pause?.

Posted: Mon, 24 Apr 2023 15:20:00 GMT [source]

A currency futures contract is a standardized form of a forward contract that is traded on an exchange. It’s an agreement to buy or sell a specified quantity of an underlying currency on a specified date at a specified price. Initial margin requirements are based on 99% value-at-risk over a daily time range.

Furthermore, there are many types of currency pairs on the market. Most of these forex pairs have INR as the quote currency, although there are foreign currency crosses available. To ensure that you have a fulfilled holiday and wholesome experiences, all our holiday services are at your beck and call. On your international holiday, we ensure that you are well-equipped with foreign exchange, visa and travel insurance. We are the pioneers of foreign exchange in India and booking forex online is simple and convenient with us.

Firstly, we defined what is meant by currency trading and the foreign exchange market, which happens to be the largest market in the world. Central banks also happen to be one of the most important currency market participants. The interest rate policies set up by central banks and open market operations have a significant impact on currency rates. They may also engage in currency interventions with the goal of making their respective currencies appreciate or depreciate. Currency pairs are denoted by writing both the currencies and separating them by a backward slash, for example USD/INR. In a currency pair, the currency on the left is the base currency and the one on the right is the quote currency.

The International currency market involves participants from around the world. Currency trading participants comprise banks, corporations, central banks , investment management firms, hedge funds, retail forex brokers, and investors like you. When you are travelling abroad you buy forex, which is mainly the local currency at an exchanged rate. The foreign exchange rate holds an important position in the tourism sector.

Along with tailor-made packages for all the renowned destinations in India, we have tour packages for intrepid travellers who love walking the offbeat paths. With us, you can explore the lush green and refreshing beauty of Coorg, quaint hills and meadows of Dalhousie, the offbeat hill town of Tawang and the scenic hills and valleys of Kalimpong, West Bengal. It goes without saying that these are just a few pearls in our holiday treasure box.

A good tutor should know when to correct his students and show them the right way. In learning forex or any other subject, the role of a role model should not be underrated. I started learning forex by myself for a little while before I had to get tutored by a professional in the field. Still date, when I have a difficult problem or questions, he puts me through effortlessly. Also, deeply passionate about sharing his knowledge of the subject matter. Not withstanding, I have been able to see first hand his prowess at developing different trading strategies to grow his returns on Fx.

After logging in, the client has to go to ‘Fund Transfer’, enter the amount of lien to be marked and is redirected to /personal, where he allocates the funds for the trade, by marking a lien. The updated lien amount can be seen on the onlinesbi homepage. The client has to visit /sbifxtrade, where he has to enter the required details and log in. Upon receipt of the KYC compliant applicant form, the trading account of the client would be opened and an email would be sent to the client with the user name and password. If USD/JPY plummets and your trading losses cause your account equity to fall below $1,000, the broker’s system would automatically close out your trade to prevent further losses.

If the flutter samples of the pair moves to 1.2001, this represents a one-pip movement. Lots and leverage are concepts that will appear on day one of your Forex trading career. Kindly update you email ID with us to receive contract notes / various contract notes electronically to avoid any further inconvenience.

Our international holiday packages are well-made and hold a high reputation among customers who have been travelling with us. Here, take a look at our top international holiday packages. The Second Strategy is what I term ‘MW Forex Strategy’ is a combination of three unique indicators that pinpoint the point of reversal in some selected currency pairs. The Base price is compared with the Settlement price and difference is cash settled. In case of profit/loss in EOD MTM, the account is respectively credited/debited.

- The undertaking for sending the contract notes electronically enables the clients to receive the contract notes and other statements instantly.

- Instead, forex trades in India operate on the basis of the market value of the underlying currency pair on settlement.

- Currency futures are traded on platforms offered by exchanges like the NSE, Bombay Stock Exchange , MCX-SX.

- Thomas Cook Forex Services can help you buy and sell forex at the best possible rates.

If you are an importer you can ‘buy’ a currency futures contract to “lock in” a price for your purchase of actual foreign currency at a future date. Thus you avoid the exchange rate risk that you would have otherwise faced. If you are an exporter, you can ‘sell’ currency futures on the exchange platform and lock in a sale price at a future date. Currency markets, or the foreign exchange markets, also known as the forex market, is the largest financial market in the world, bigger than even the stock market. There exist certain factors which happen to be unique to the forex market and in this article, we will understand how currency trading works in India. When you open a demat account for your stock trading transactions, you may start trading by borrowing money from a brokerage for any stock investment you wish to make.